Credit Cards – Explained for Teens!

What is a Credit Card?

Previously we looked at different types of cards you can get from setting up your first bank account, and credit cards came up. Here is a deeper understanding of other types of credit cards for teens and the rules that credit cards follow.

A Credit card allows you to borrow money from the bank or company and pay it off when you have earned money back.

You can use comparison websites such as Compare the Market and Money Supermarket to see what card best suits you. These are usually for adults and are not the same as actual credit cards for teens that they may use in early adulthood. Credit Cards for Teens comes under ‘What Card is for me?’ in this blog.

Depending on what type of card you are interested in depends on what you want to do with the money.

You could plan to go on holiday and travel worldwide for a year. You could be thinking of buying your first house. You could be starting your first business selling sports cars locally.

All these aspects could make you consider getting a credit card.

We understand that this is all in the future and that you won’t be considering these ventures yet. We are simply becoming prepared for when that time comes as it’s best to get ahead so you can make the right decisions.

https://youtu.be/zwudxJvQ3bM

Types of Credit Cards – Credit Cards for Teens

Banks guarantee safety with your money.

Credit cards can be offered by banks and companies also.

This may be a reason why many people don’t own them. It is hard to trust yourself with paying others back and companies who place rules on your card.

Here is a breakdown of many types of credit cards:

- Rewards cards

This card offers rewards, gifts and discounts on various activities when you spend money on it.

It works by spending money on your card; the company/bank gives you points for spending and paying them back. You then spend these rewards/points and get further opportunities.

They may provide cashback when you pay for something at a shop. This means that when you pay for your local food shop, the person behind the till may be able to give you £20 in cash, free of charge.

Reliability with these companies is essential. Always remember that by having you as a customer, they can earn money from you and provide strong relations with other companies.

Both of you will get benefits from owning a credit card.

If you cannot be reliable, your money will suffer. These companies will charge you more than you borrowed. And if you have to pay more and can’t, the money can keep going down until you are in debt.

- Travel credit cards

Simply, travel cards are for taking your money abroad to other countries.

When you go on your first holiday, you’ll want a card with cash to pay for items abroad.

Using a regular card can charge you exchange rates for every purchase. In other words, every time you buy dinner, tickets, food and lots more, you’ll be charged a price to convert your money from euros to pounds or pounds to dollars etc. This can be extremely annoying.

Travel credit cards can have no fees when it comes to spending abroad and can also reward you based on what you buy. If you don’t have enough spending money for the trip, you can spend on these credit cards and pay the following month. Watch out, however! They charge interest per day you are late on repayments.

- Cash back credit cards

This credit card does what it says on the tin.

Spend a certain amount of money every month, and whatever the percentage the company sets, it is how much you will get back in cash per month.

These are usually limited in how much cashback you can get from your spending. However, they usually encourage big spending and will reward you for the first $10,000 you spend on it. So, if you are thinking of buying a car, this is perfect for getting rewards back on your card.

- Business credit cards

When companies start up, they usually apply for a business credit card.

This help to spend money on materials, experiences and facilities for all employees and customers whilst maintaining a budget.

It’s to bring morale to the team and allow your company to manage their monthly spending. You can see how much is going in and out of your business monthly.

What Card is for me? – Credit Cards for Teens

Right now, children as young as six can get pre-paid cards. They operate similarly to credit cards, but instead of you paying the money, your parent or guardian does.

You can take money out and pay with cash in shops. It allows you to prove that you are a young adult.

It has limited spending, so you can feel safe using this independently. Your parent/guardian can set spending limits daily, weekly or monthly. Both you and your parent/guardian can see how much you are spending through an online app on your phone. This is a perfect way to get started with managing and saving money.

Further on in life, you need to consider whether credit cards are essential.

We wouldn’t recommend getting a credit card if you are at university or still in education by 18. This can be very risky as your finances need to be more secure. Security comes from monthly income from a job.

Understanding Credit Cards Successfully – Credit Cards for Teens

If you manage to get a credit card and use it successfully, this can lead to future opportunities. Your credit score rating could be very high.

Banks can provide loans for many things you cannot afford, especially houses, cars, business ventures etc.

Starting with a prepaid card and saving account early is advised.

Then, consider all these different types of credit cards to help you finance your lifestyle when you are older.

The reasons to get a credit card are as shown:

- Earn points and rewards

- To help with getting out of debt

- Improve your rating for future big purchases

- To spend abroad without fees

- Managing money in monthly instalments

If some of this is still confusing and you are struggling to know whether a credit card is appropriate to get just yet, always consider setting up meetings with your local bank and always ask questions if you don’t understand what a specific rule means.

ACTIVITY

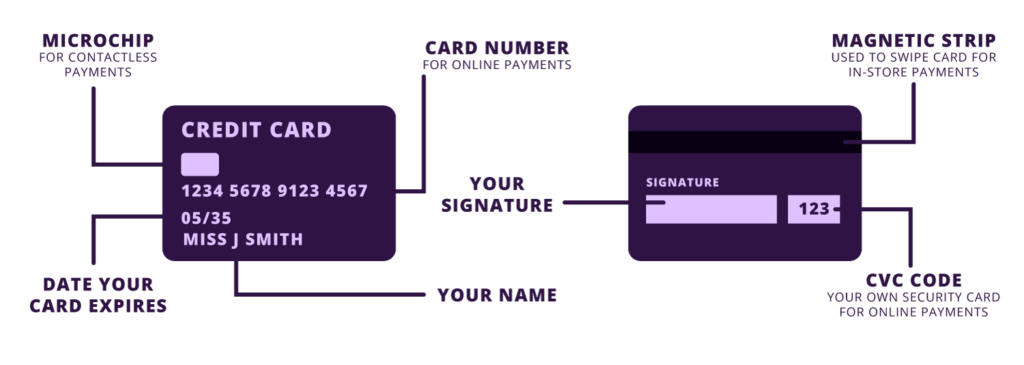

Draw your own credit card!

What type of credit card is it? State at what age you would need this card. What are you doing in your life that would make you need this type of card?

Now look up the terms and conditions that apply for this credit card and write them down. What is the interest and APR on this card?

Your card should look something like this. Place all relevant information around and on the card.

Want to Learn more?

Log into your CFS online account and find out more about Money Management!

Further Studying on Credit Cards for Teens

- Further understanding of children’s pre-paid cards:

- Top prepaid cards and bank accounts for under 18s – MSE (moneysavingexpert.com)

- Everybody Hates Chris TV Show – The episode discusses the problems of spending a lot of money on a credit card and the repercussions of being in debt:

- Everybody Hates Chris | Do NOT Hide a Credit Card From Your Wife – YouTube

[…] an adult, you may own multiple bank accounts and cards for different areas, such as saving money, credit scores and attending university. If you aren’t sure what these types of accounts are and need to brush […]