What is booking keeping?

My first account book – What is booking keeping?

Before we understand how to spend money, we must earn it. After we have earnt money, we must try to save it.

You could start your own video content creator business. It would be best to have savings to carry this dream into adulthood.

When you become an adult, you may own multiple bank accounts and cards for different areas, such as saving money, credit scores and attending university. If you aren’t sure what these types of accounts are and need to brush up on your knowledge, you can look at different types of bank accounts here.

The point is that life can be confusing, and it is hard to keep on top of how much you are earning, spending and saving.

When you open your bank account at the end of the month and see that there is only $20 remaining, this can be unbelievably upsetting. But there is a way of managing this issue. Therefore, you would need to start your first account book.

What is book keeping?

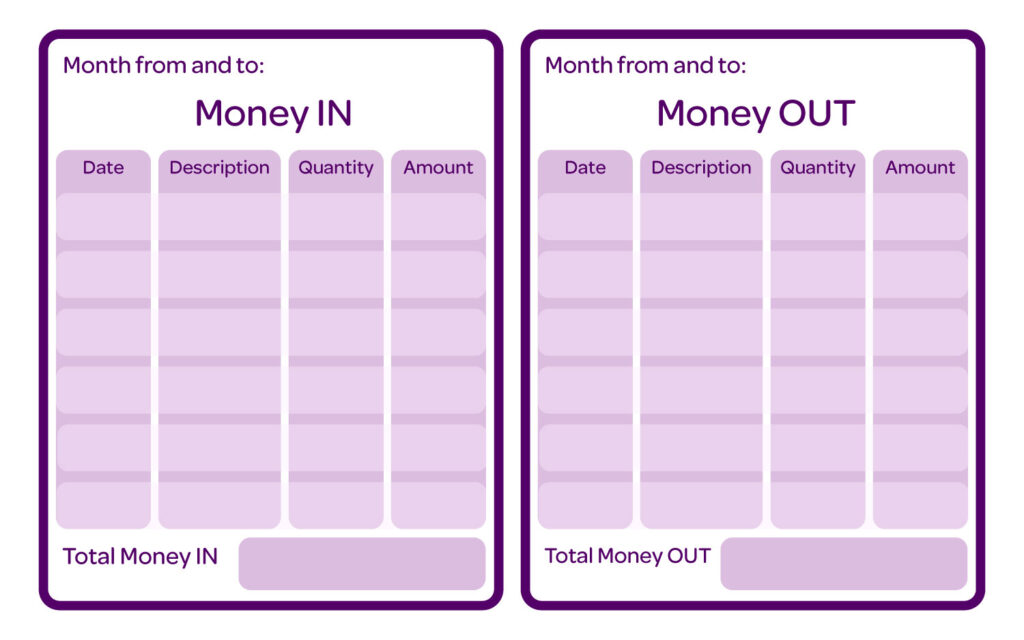

Your first Account books are usually in a table format stating everything you have spent in a month.

They have information on when and how much you spend.

They can also categorise these items into subjects or groups.

Why would you use Book Keeping?

Your first account book is important for a clear state of mind. If you know how much is coming in and out of your account, you’ll be more aware of when money leaves your hands and for the right reasons. Everyday people should be able to do this.

They are also important in the lead-up to creating your own business. If you set up your first account book that can track savings and income, you know how much you can spend or save on future goals.

First Account books are very important if you own a business. They can help you earn more money monthly and help your company grow by being clever and thinking about your spending.

How to write out an account book.

Your First Account Book can be written down much like this:

Now you know? What is booking keeping? Then what is accouting? Let’s understand it easily.

Income is a display of how much money you must work with for the month.

We often may get carried away and spend more than we earn. It would help to be careful; an account book is how you may do this.

You can budget your money accordingly to figure out how to save for the future.

Based on how much money you have to work with for the month, working adults are recommended to save 10% of their income. So, if you earn £2000 every month, you should put £200 into a savings account.

Many teenagers don’t have the same problems as adults. This means you have more money to work with.

We recommend that you treat yourself with your earnings and save at least 50% every month. This will go a long way in the future.

Ways to save with your account book

- Consider putting that 50% into a different bank account when income enters your account. Then you won’t be able to spend it when you go out.

- Plan for next month! If you have spent over 90% of your money this month, figure out how to organise this better for the following month. Create a limit on your spending.

- Ask your parents/guardian to match your savings. If you save £50 this month, they could match you and put £50 into your savings account.

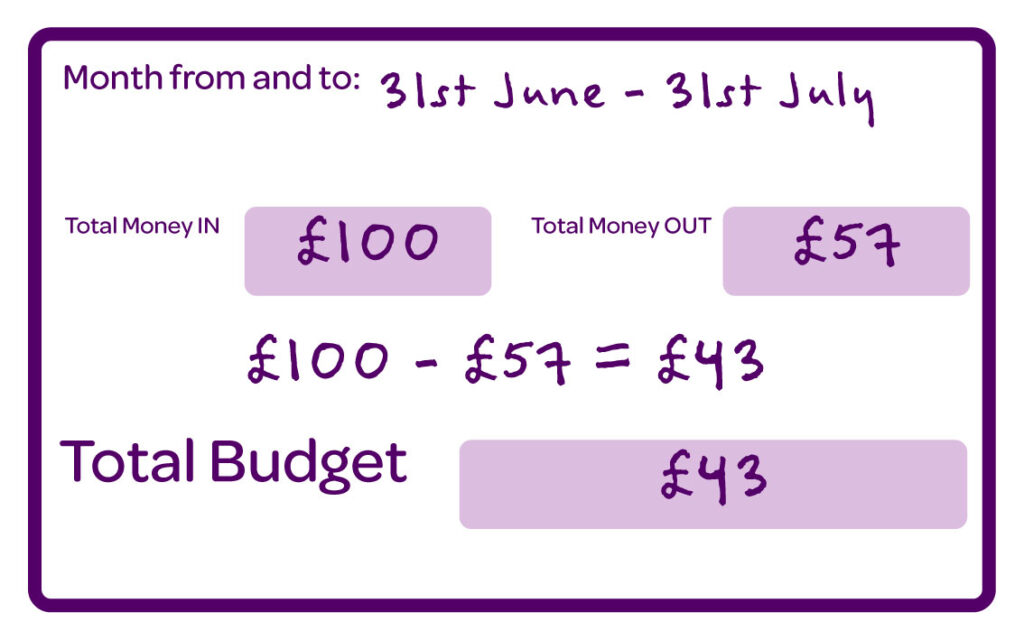

- Budget – save so that you have money to spend. If you get to the end of the month and have put away savings already, you may realise that you still have money left over. This is brilliant! This means you can use this money to spend how you like or put it into your savings. Once you get used to using your income every month, you’ll soon understand that you may have a few hundred to work with. This could be your monthly budget.

A budget at the end of your account book can look like this:

- And finally plan to make a profit from your hobbies. You could be into baking. Spend your leftover money or savings on baking cookies to sell and make profit from.

ACTIVITY

Anne loves to bake. She wants to own a bakery or cake shop one day. She spends £10 on baking ingredients to sell cookies at a local fair.

Ann can make a total of 30 cookies from the ingredients.

If we sell 30 cookies at £1.50 each she will have £45 at the end of the day.

What is Anne’s profit from this?

ACTIVITY

Materials needed:

- First Account Book/Cash Book

- Pen or pencil

- Play money or real money

Instructions:

- Set up a mock business or activity. For example, you could run a lemonade stand or sell handmade crafts.

- Use the first account book/cash book to record all transactions related to the business or activity. This could include sales, expenses, and any other financial transactions.

- Practice making entries in the account/cash book for various transactions. For example, record a sale of $5, a purchase of supplies for $2, or a payment to a supplier for $10.

- Use play money or real money to simulate the transactions. For example, if you record a sale of $5, exchange play money or real money for the product sold.

- Review and analyze the entries in the account/cash book. Look for patterns or trends in sales, expenses, and profits.

- Adjust entries as necessary. For example, if you made an error in recording a transaction, correct it in the account/cash book.

This activity can be adapted to various levels of complexity and can be a great way to practice bookkeeping skills. It can also be a fun way to learn about basic business and finance concepts!

Further Reading and Studying

- Online Accounting Software – UK | Zoho Books

- 19 Free Financial Literacy Games for High School Students (moneyprodigy.com)

- If you understand this topic want to learn more, take our online learning programme here at CFS! You’ll be a money making whizz in no time!